Energy transition requires grid, grid requires everyone’s support

“The PCI label will sound great to a banker’s ear… if it was granted for a longer and stable period of time” (P. Bernard, Friends of the Supergrid, Jun/15)

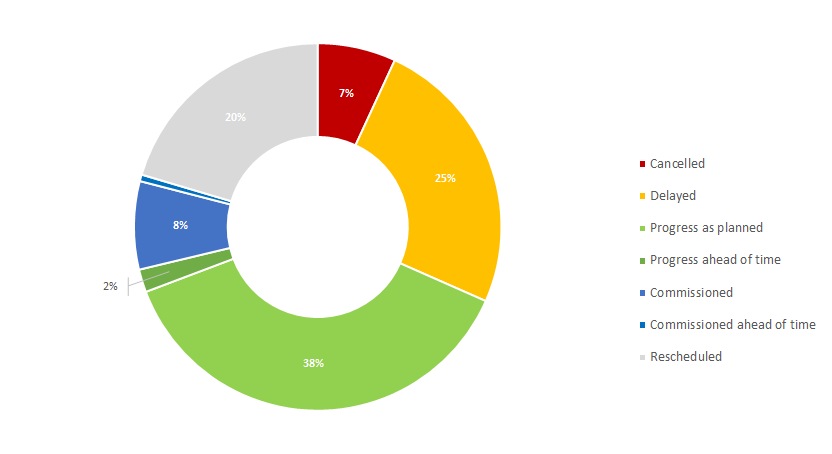

The TYNDP 2016 ,unfortunately, confirms the trend identified in the previous TYNDPs, with moderate progress: about 25% of TYNDP investments suffered delays in the past two years (compared with 33% in 2014), though more are being rescheduled (22% now compared with 12% in 2014). TYNDP monitoring also shows that of the TYNDP2014 investments in a design or permitting stage two years ago, at present 20% are under construction, and 5% has been commissioned. Making the comparison with TYNDP2012, these levels are respectively 30% and 10%. Implementation monitoring also shows that of the TYNDP2016 investments presently in design or permitting phase, on average these items have faced a delay of one year since 2014, and three years since 2012.

The framework for Projects of Common Interest is promising but is only beginning to generate its effect and take momentum. It is still being implemented, with first annual feedbacks from EC to Member States about implementation and tuning. All or most PCIs now in the authorisation process appear to meet the 3,5-year timeframe set for getting all authorisations. Still, the alignment of national procedures for cross-border projects may require further harmonisation, as some authorisations may fall off the 3,5-year timeframe. Experience will show where inconsistency issues may require improvements in the future. It is also important to note that PCI best practices could be applied to national transmission projects which are crucial to the achievement of Europe’s targets for climate change, renewable energy and market integration.

Connecting Europe Facility, the European Bank for Investment and specific funds are ready to support project promoters. Financing becomes less of a structural issue, but can remain critical for some projects.

Figure 14 Evolution of TYNDP 2014 project portfolio

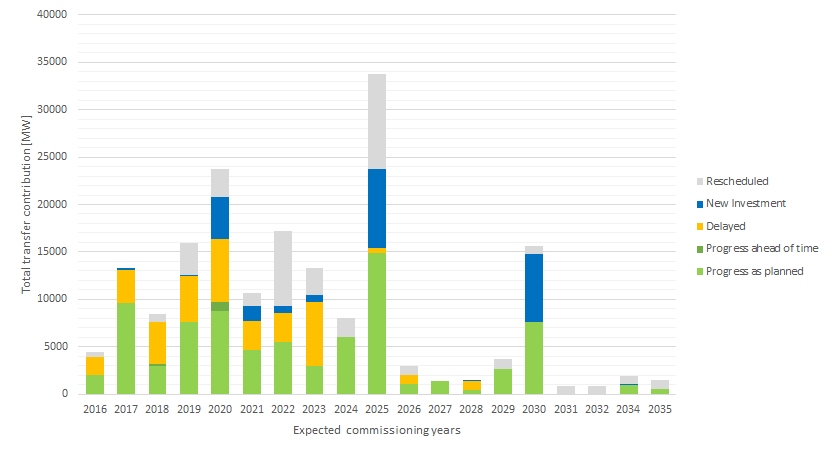

Figure 15 - Additional grid transfer capacities introduced by TYNDP investments in the coming decades; with a note of the present (2016) status of these investments

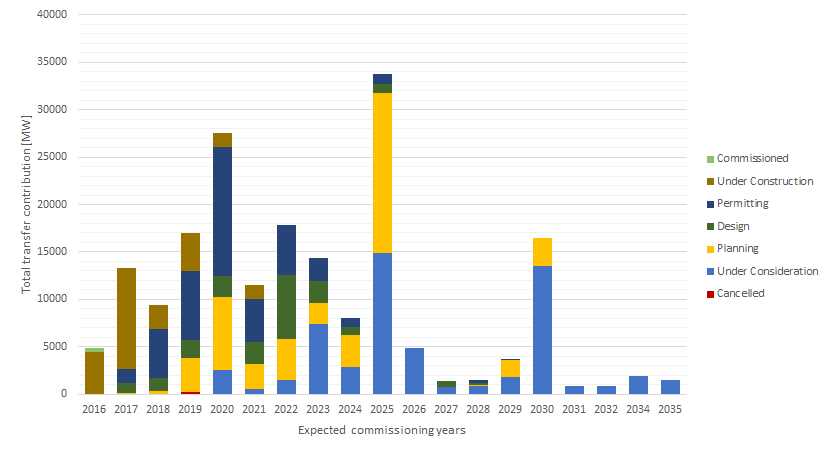

Figure 16 - Additional grid transfer capacities introduced by TYNDP investments in the coming decades; with a note of the progress since 2014