North-South interconnections in Western Europe - regional planning

How to plan a grid to manage connection of large renewable plants in the North and in the South? How to move large quantities of renewables accross long distances? See how the energy transition is game changing network development in Western Europe.

Introduction

This document addresses grid development issues in the geographical area covered by the “North-South Electricity Interconnection in Western Europe” Corridor (‘NSI West Electricity’) established by Regulation (EU) No. 347/2013 (‘The Energy Infrastructure Regulation’).

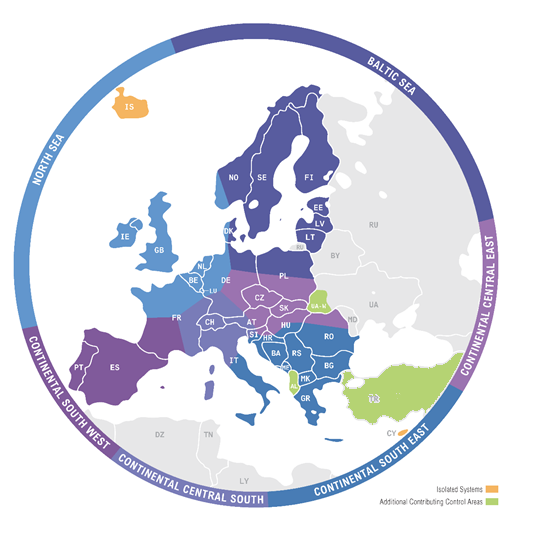

It bases on the achievements of TSOs’ efforts striving to ensure adequate and timely grid development while closely coordinating within three ENTSOE Regional Groups: North Sea, Continental Central South and Continental South West the perimeter of which is shown on Fig 1.1.

Figure 1‑1 ENTSO-E System Development Regions

Main Drivers for Grid Development

Challenges in the region

The following trends can be observed over the coming 15 years and beyond:

RES development

Following the EU objectives, especially wind and solar power units. Wind energy is in most Visions specially expected to be further developing in the northern and western parts of the Region (northern Germany, United Kingdom, Ireland and northern France) and in the South (Spain, Portugal and Italy); significant development of the solar power units is expected in southern part (Italy, Spain and Portugal) but also in France and southern Germany. Northern countries benefit from RES-balancing opportunities with hydro-RES located in Scandinavia via interconnections1.

Such a development of variable renewable resources, which are often located far from the load centers, triggers high and volatile bulk power flows, basically along the North-South and West-East axes, that the transmission grid must accommodate. It is also quite challenging for the system security and frequency control as the system must provide suitable back-up generation (or find other alternatives) at any time. In order to increase operational flexibility an increased exchange between transmission and distribution systems can be expected as well. Far distance RES-electricity transports, especially via HVDC lines, will facilitate using RES energy where it is most needed, increasing its value for the region.

Conventional generation

Conventional generation like combined cycle gas turbines are still under developement, even though the European electricity market conditions in general are less favorable for such power generation for the time being. Some countries phase out nuclear totally (DE, CH, planned in BE) or partially (FR), while GB builds new nuclear. In addition, another phenomenon to be carefully monitored from the system security perspective is linked to the dismissal or mothballing of a significant amount of conventional generation (especially from oil, coal and gas thermal power). This is a market driven trend, mainly due to the development of new RES capacity and slowing down in the evolution of the electricity demand, which is expected to keep on further in the next years. As a consequence of this and to ensure security of supply, new market design is currently discussed.

Storage development

Storage plants can be used in order to facilitate the efficient use of RES. Considerable storage potential is available in the southern part of the region through the hydro pumped storage potential located in the mountains, mainly in the Alps but also in Massif Central and Pyrenees and also in Portugal and Spain. Reservoir hydro and run-of-river is located the Nordic countries as well, serving as a seasonal “battery” for the region’s countries connected to Scandinavia. Further opportunities could be considered concerning development of distributed storage systems within or near peripheral areas with expected higher RES penetration to reduce local congestions. In this respect, some network development projects are aimed also to better integrate storage projects in the power system.

Climate change mitigation

Climate change mitigation and competition will require energy efficiency measures such as transfer from fossil-fuel based end-users to CO2-free energy sources. Electricity peak demand is, depending on the Vision, assumed to grow either moderately or rapidly by the year 2030, based on different assumptions and demand forecast factors taken into consideration in the Visions.

Market integration

Versatile market flows across Europe following price signals very quickly trigger grid development. This is of major relevance for the bidding zones (within a Country or among different Countries) characterized by limited competition due to lack of transmission capacity with neighboring areas endowed with more competitive RES or thermal power resources.

Increasing the interconnection of peninsulas to the main European grid

Despite the projects commissioned in the recent period, some countries in the region still suffer from interconnection rates below the 10% target set by the European Council: this is the case of Italy and especially of Spain. In the latter case, the boundary between the Iberian Peninsula and the rest of Europe is under high political pressure, as expressed in March 2015 by the concerned Members States and the European Commission in the Madrid Declaration. In addition, the main islands around Italy, including Corsica, need further interconnection to mainland.

Security of Supply improvement

the energy transition of the regional power system leads to increased power flows on the north-south-axis. In order to ensure security of supply and to improve system stability not only new DC and AC grid expansion measures are needed, but also additional reinforcements such as VAR-compensation. In order to prevent a lack of supply it is essential to increase cross-border capacities between European countries and reinforce the internal transmission systems.

Main bottlenecks in the region

Potential bottlenecks (unless new transmission assets are developed) have been identified starting from the present network constraints and taking into account the expected evolution of the power system in the coming years.

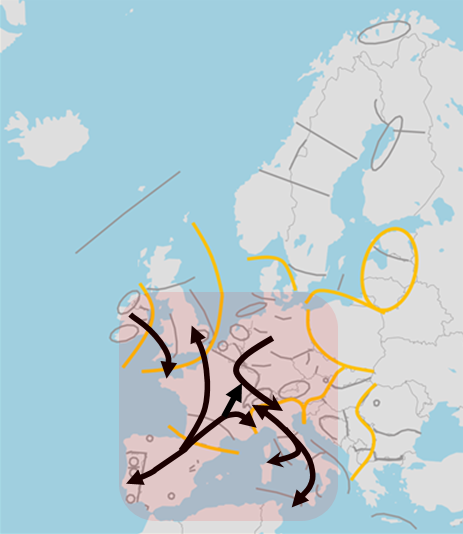

The yellow lines on Figure 2-1 represent the most significant boundaries whereas the grey lines show the regional barriers. The black arrows depict typical bulk power flows that the grid needs to accommodate in the region2.

Figure 2-1 Main bottlenecks in central and western region

The main boundaries due to market integration needs include Portugal-Spain border, the France – Spain border, the Italian northern border, the boundary corresponding to future exchanges between the European and the North African systems through Italy, the internal bottlenecks among the six different Italian price zones and between Italy and Corsica, the Swiss roof, the French north-eastern border and the German border towards Denmark. Moreover, a need for the transmission capacity increase within the same price zone can be recognized in Germany (due to high north to south flows) and in the south-western part of France (due to high flows in both directions).

Critical sections due to connection and integration of generation (especially RES) relate to already public and mature applications for connecting large generation plants, storage plants, and areas with high penetrations of RES. The primarily concerned boundaries of the region are: the connection of offshore wind in North Sea and Baltic Sea in Germany; the connection of additional hydro power plants in Switzerland, Austria and Portugal; integration of renewable generation expected in the north of the region (mainly wind onshore and offshore in Germany and France), solar in the southern part of Germany, France, Portugal and especially in Italy and Spain.

Generation is generally sufficient to balance load. Security of supply remains a concern especially locally, in peripheral areas with scarcely meshed network (like Italian main Islands and Corsica).

Grid Development in the Region

Transmission projects portfolio

The following table lists the boundaries in the region with their specific drivers for grid development and the corresponding projects3 that are assessed in TYNDP2016 for 2020 and 2030 time horizons. The assessment stems from extensive coordinated grid and market studies in the region over the last two years, devising new projects to cope with the needs. In that respect, it is worth mentioning that TSOs are working hard in close coordination every day in order to make the needed projects happen.

In the table below, Mid-Term projects are printed in red, Long Term projects in blue, Future projects in black. “Candidate projects” that were introduced after 2015 Common Planning Studies only for testing the interest of additional projects are omitted.

Area | Driver | Proposed solutions | Name of the project | PCI label | Main benefit from the project |

Italian Northern Boundary4 | Integration of the Italian peninsula. High north to south flows triggered by power exchanges at the Italian Northern border, mainly from the Alps area and Germany. | p. 21 | Savoie-Piemont | 2.5.1 | Increase FR-IT capacity by about 1200 MW |

p. 31 | San Giacomo | 2.15.1 | Increase IT-CH capacity by about 1000 MW | ||

p. 174 | Greenconnector | 2.14 | Increase IT-CH capacity by about 800-1000 MW | ||

p. 250 | Mese- Castasegna | - | Increase IT-CH capacity by about 100 MW | ||

Italy-Tunisia | Interconnecting the Euro-Mediterranean System to integrate the European and the North African systems. | p. 29 | Interconnection Italy - Tunisia | - | The project while realizing 600 MW transmission capacity between Italy and Tunisia, will contribute to reduce present and future limitations to the power exchanges on the northern Italian border under specific conditions, therefore it will allow to significantly increase the transmission capacity and its exploitation by at least 500 MW on that boundary. |

Transport RES power to integrate it in the pan-European system | p. 283 | TuNur | - | Provide transmission capacity by about 1000 MW | |

Italy - Corsica | HVDC interconnection of the Corsican system to Sardinia and the Mainland | p. 299 | SA.CO.I. 3 | - | Realization of a 400 MW link between Sardinia - Corsica and Italy, enabling the exchange of 100 MW between Italy and Corsica (FR), to integrate Corsica in the European market, with significant improvement of the SoS of the Corsican and Sardinian systems. |

Swiss Roof | Increase of cross-border capacity between Switzerland and neighboring countries and RES integration | p. 264 | Swiss Roof I | - | Project Swiss Roof I increases the integration of the Swiss transmission grid into Europe and helps connect the existing and new Swiss storage and pump storage power plants located in the Alps to the Swiss Mittelland. |

p. 263 | Swiss Roof II | - | Project Swiss Roof II further increases the integration of the Swiss transmission grid into Europe. | ||

p. 266 | Swiss Ellipse I | - | Swiss Ellipse I creates a ‘generation bus’ running through the Swiss Alps and helps connect the existing and new Swiss storage and pump storage power plants located in the Alps to the Swiss Mittelland and to Europe. | ||

Italy-center/Italy north | Removal of the bottlenecks between market zones internal to Italy to better integrate Italy in the European market | p. 33 | Central Northern Italy | - | Increase the transmission capacity between IT Center and IT north by about 400-600 MW. |

Italy-South/Italy central | Removal of the bottlenecks between market zones internal to Italy to better integrate Italy in the European market. | p. 127 | Central Southern Italy | - | Increase the transmission capacity between IT South and IT center market zones by about 1200 MW. |

Germany – Netherlands | Flows from the North of Germany to the South-(West) area of CWE. In Vision 4, additional wind production in the North of Germany triggers additional congestion on the Northern part of the border. | p. 113 | Doetinchem - Niederrhein | 2.12 | The project will increase the cross border capacity and will facilitate the further integration of the European Energy market especially in Central West Europe. The new line will also increase the security of the transmission capacity. |

p. 245 | Upgrade Meeden - Diele | - | Increase of the interconnection capacity between The Netherlands and Germany by approximately 500 MW | ||

Belgium – Germany

| Flows from the North of Germany to the South-(West) area of CWE, planned nuclear phase out in Belgium | p. 92 | ALEGrO | 2.2 | ALEGrO as the first DE-BE link contributes with 1 GW to the development of interconnection capacity on the BE-DE border |

p. 225 | 2nd interconnector Belgium - Germany | - | Preliminary studies have indicated potential for further regional welfare increase by further increasing the interconnection capacity between Belgium and Germany. | ||

France – Germany | High and volatile west-east and east-west flows through France and Germany due to RES development. Highest in Vision 4. | p. 228 | Muhlbach – Eichstetten | - | Upgrade and reinforcement of the existing circuits between Eichstetten and Muhlbach/Vogelgrun in order to increase the thermal capacity of the lines. |

p. 244 | Vigy – Uchtelfangen area | - | Upgrade of existing transmission OHL between Vigy and Uchtelfangen (or beyond) to increase its capacity. | ||

Germany – Switzerland | Integration of RES generation mainly in Germany and connection with pump storage power plants in the Alps | p. 231 | Tiengen - Beznau | - | Increase of the interconnection capacity between Germany and Switzerland by approximately 1000 MW |

France - Switzerland | Need to increase the transfer capacity and accommodate higher and more volatile power flows in Europe but also to integrate new pumped storage generation in Switzerland | p.22 | Lake Geneva West | - | Upgrade of existing 225 kV grid in order to increase by 500 MW the capacity from France to Switzerland and secure the supply to Geneva area |

p.253 | Upstream reinforcement in France | - | Upgrade of existing 400kV line and installation on Phase shifter in order to increase the exchange capacity between France and Switzerland | ||

p.199 | Lake Geneva South | - | Upgrade of existing 225kV grid, possibly to 400kV in order to increase the cross-border capacity | ||

Belgium - Netherlands | Increasing integration of wind in the northern part of Germany results into higher and more volatile bulk power flows that can be exported from Germany in favorable meteorological conditions, through the Netherlands and into/through Belgium. | p.24 | BRABO | - | Facilitate market integration by increasing the interconnection capacity between Belgium & Netherlands.

|

p.262 | Belgium-Netherlands Future Evolution | - | The project envisions to further develop the interconnection capacity between Belgium and the Netherlands in addition to the BRABO project, quantified by a further 1 GW increase. | ||

Netherlands internal 380kV ring | Bottlenecks on multiple 380 kV internal ring lines. | p.103 | Reinforcement NL Ring | - | The project reinforces the Dutch grid to accommodate new conventional and renewable generation, to handle new flow patterns and to facilitate the cross-border capacity increase with neighbouring countries. |

Netherlands-Denmark | Overall RES integration (mainly wind energy, both on- and offshore) in this local area keeps on increasing, thus the grid infrastructure needs to be upgraded respectively. | p.71 | Cobra | 1.5 | New single circuit HVDC connection between Jutland and the Netherlands via 350 km subsea cable. Capacity of 700 MW |

p.237 | Cobra 2 | - | |||

Luxembourg - Belgium | Increase of the transfer capability between LU, DE and BE and contributing to the security of supply. | p.40 | Luxembourg-Belgium Interconnection | 2.3.2 | In a first step a phase-shift transformer is integrated at Schifflange (LU) and the Luxembourg network is being reinforced by creating a loop around Luxembourg city, including substations for in feed in lower voltage levels,hereby enabling the existing line Aubange (BE) - Schifflange (LU) to figure as interconnector |

Belgium - France | Structural bottleneck in both visions, with high loadings already in N condition. | p.23 | France – Belgium Phase 1 | - | The project aims at ensuring reliable grid operation to cope with more volatile south-north flows, and at increasing the interconnection capacity between France & Belgium to sustain an adequate level of market integration. |

p.173 | France – Belgium Phase 2 | - | |||

p.280 | France – Belgium Phase 3 | - | |||

Mibel – Rest of Europe | Increase of capacity between the Iberian Peninsula and the rest of Europe. Declaration of Madrid (March 2015) and 10 % interconnection ratio target | p. 184 | PST Arkale | 2.8 | The project increases interconnection capacity between France and Spain (100 MW FR-ES, 500 MW ES-FR) |

p. 16 | Biscay Gulf | 2.7 | The capacity between France and Spain will reach 5000 MW in both directions | ||

p.270 | Aragon – Atlantic Pyrenees | Part of 2.27 | The project aims to increase the capacity between France and Spain by 1500 MW | ||

p.276 | Navarra - Landes | Part of 2.27 | The project aims to increase the capacity between France and Spain by 1500 MW | ||

Portugal-Spain

| Increase the interconnection capacity between Portugal and Spain | p. 4 | Interconnection Portugal-Spain | 2.17 | Increase the interconnection capacity between Portugal and Spain (PT to ES 700-1000 MW and ES to PT 1300-1900 MW) |

p. 269 | Uprate the Western 220 kV Sevilla Ring | - | Solve the limitations in the Portugal to Spain direction exchanges in certain situations (500 MW) | ||

Internal South West of France | Integration of RES generation, connection of future pump storage, phase out of French nuclear, high exchanges with Spain | p. 158 | Massif Central South | - | Integration of existing and new wind and hydro generation (including pump storage). |

p. 216 | Massif Central North | - | Integration of RES with high exchanges with Spain. | ||

p. 249 | Façade Atlantique | - | Project needed to accommodate the French energy transition (RES and phase out of nuclear). Also linked to the level of flows with Spain. | ||

Internal Portugal

| Reinforcement of the internal network to facilitate the integration of existing and future RES generation (Wind and Solar) and Hydro with and without pumping | p. 1 | RES in north of Portugal | 2.16.1 and 2.16.3 | Integration of RES generation (Hydro with pumping and wind) |

p. 2 | RES in center of Portugal | - | Integration of RES generation (Hydro with pumping and wind) | ||

p. 85 | Integration of RES in Alentejo | - | Integration of RES generation (mostly solar but also some wind) | ||

Internal Spain

| Reinforcement of the internal grid to facilitate the integration of existing and future RES generation and accommodate unbalances power flows | p. 13 | Baza project | - | Integration of new wind and solar generation and a possible new pumping hydropower plant |

p. 157 | Aragón-Catalonia South | - | Integration of new RES generation in Catalonia area and accommodate power flows between Aragón and Catalunya | ||

p. 194 | Cartuja | - | Integration of an important amount of wind power energy mainly offshore in the South of Spain | ||

p. 193 | Godelleta-Morella/La Plana | 2.26 | Integration of existing RES in the eastern part of Spain and accommodate important south-north flows in the Levante area of Spain. This reinforcement complements the Cantabric-Mediterranean axis | ||

p. 203 | Aragón-Castellón | 2.25.1 and 2.25.2 | Accommodate geographical unbalances between Northern Spain and Mediterranean area reducing the congestions with high exchanges between Spain and France | ||

p. 255 | Connection Navarra-Basque Country | - | Integration of existing RES. Robust network to integrate flows from/to the future FR-ES interconnection Navarra-Atlantic Pyrenees | ||

p. 151 | Asturian Ring | - | Ensure the demand growth of the coastal and central area of Asturias in the North of Spain, in a future with a very low thermal production | ||

Ireland-Continent | Complementarity between the wind dominated system in Ireland and available conventional generation on the continent | p.107 | Celtic Interconnector | 1.6 | First HVDC subsea connection between Ireland and France with 700 MW capacity that will foster wind energy integration, transmit market flows and also provide mutual support |

Great Britain – Continental Europe and Nordics | The North Seas region’s flow patterns differ between the Visions. Depending on the Vision, Great Britain is either the Region’s sink or source, i.e. the regional flows go either to or from Great Britain, which means projects serving these corridors will have high utilization hours. | p.25 | IFA2 | 1.7.2 | New subsea HVDC VSC link between the UK and France with a capacity around 1000 MW |

p.74 | Thames Estuary Cluster (NEMO) | 1.1.1 | New DC sea link of 1000 MW over a distance of around 140 km between Richborough (GB) and Gezelle (BE).1000MW | ||

p.75 | Stevin & Modular Offshore Grid | 1.1.1 | This project facilitates the integration of up to 2.3 GW offshore capacity into the Belgian grid | ||

p.153 | France-Alderney-Britain | 1.7.1 | New 220km-long HVDC subsea interconnection between Exeter (UK) and Menuel (France) with VSC converter station at both ends. Expected rated capacity is 2*700 MW. | ||

p.167 | Viking DKW-GB | 1.14 | 2x700 MW HVDC subsea link across the North Seas | ||

p.172 | ElecLink | 1.7.3 | New FR - UK interconnection cable with 1000 MW capacity though the channel Tunnel between Sellindge (UK) and Mandarins (FR). | ||

p.110 | Norway-Great Britain North Sea Link | 1.10 | A 720 km long 500 kV 1400 MW HVDC subsea interconnector between western Norway and eastern England

| ||

p.190 | NorthConnect | - | New interconnector planned to be a 500 kV 1400 MW HVDC subsea interconnector

| ||

p.247 | - | New 2000 MW HVDC link between FR and GB | |||

UK | Off-shore wind connection | p.86 | East Coast Cluster | - | Multiple offshore HVDC and AC circuits and connecting platforms joining to multiple onshore connection points. |

Wales | Reinforcement of the internal grid to faciliate the integration of nuclear plant and RES | p.79 | Wales Cluster | - | New HVDC interconnection with possible offshore connection points at the Irish Sea offshore wind farms |

UK – Scotland | Facilitate the connection of RES and the connection of the remote Scottish Islands | p.77 | Anglo-Scottish | - | New 2000 MW HVDC Link on the West Coast of the UK. |

Ireland – Northern Ireland | Substantial demand growth in the area. | P82 | RIDP I | 2.13.2 | Facilitate connection of renewable generation in the North and West of the Island. It will further integrate the Ireland and Northern Ireland transmission systems and provide capacity for substantial demand growth in the area. |

P81 | North – South Interconnector | 2.13.1 | |||

Ireland – Great Britain | Stronger interconnectors of the Irish and Great British systems, enabling the benefits of an overall integration with Continental Europe and the Nordics. | p.189 | Irish Scottish Links on Energy Study (ISLES) | 1.9.2 | Offshore wind or tidal power can be brought to either two shores, |

p.286 | Greenlink | 1.9.1 | A subsea HVDC interconnector between Wales and Ireland. Capacity of 700 MW | ||

p.287 | Greenwire South | - | HVDC link between Wales and IrelandCapacity of 1300 MW | ||

p.289 | MAREX UK-Ireland Interconnector | - | Underground cable-OHL-subsea cable combination transmission from Mayo to Dublin 1500 MW | ||

p.290 | Greenwire North | - | An HVDC link between Wales and Ireland. Capacity of 1000 MW | ||

p.292 | Greenconnect | - | A subsea HVDC interconnector between Wales and Ireland. Capacity of 700 MW | ||

p.295 | Gallant | - | A subsea HVDC interconnector between South West Scotland and Northern Ireland 500 MW | ||

DKW-DE | Accommodation of bulk market flows on the North-South axis between Nordic and Continental countries, triggered by cheap Nordic hydro or wind generation sending power to the thermal /wind Continental system | p 183 | DKW-DE, Westcoast | 1.3.1 | New 380 kV cross border line DK1-DE for integration of RES and increase of NTC up to 3000 MW |

p 39 | DKW-DE step 3 | 1.4.1 | New 400 kV line replacing existing 220 kV system, increasing cross border capacity to 2500 MW | ||

Internal DE grid

| Accommodation of high flows from North to South – driven by combination of high RES infeed in the North and high consumption in the South with phase out of power stations in the South. | P. 205 | Halle/Saale – Schweinfurt | 3.13 | DE projects deliver large European benefits especially in terms of transmission capacity increase to connect and integrate RES and improve SoS. |

P. 251 | Hamburg – Audorf | 1.4.2 | |||

Audorf – Hamburg Nord | 1.4.3 | ||||

P. 254 | Osterrath – Philipsburg) | 2.9 | |||

P.235 | Brunsbüttel – Grossgartach) & Wilster-Grafenrheinfeld | 2.10 | |||

P.130 | Wolmirsted-Area of IsarBavaria | 3.12 |

Boundary adequacy

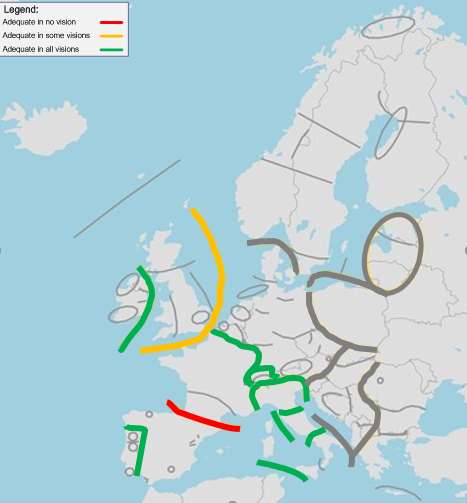

The analysis of the target capacities is to be considered as the starting point for the assessment of the transmission adequacy and the identification of any further network development needed for 2030 and beyond.

The target capacity for every boundary corresponds in essence to either the 10% interconnection ratio objective where it is not fulfilled, or to the maximum transmission capacity value, beyond which additional projects would most likely not bring enough benefits to outweigh the costs. Then, comparing the target capacity and the project portfolio for every boundary, a transmission adequacy indicator could be evaluated.

In order to identify a wider spectrum of further potential needs, it is recommendable to analyze the transmission system under the different development conditions portrayed in the four 2030 visions, leading to intensified interactions between market areas, higher usage of the transmission capacity and therefore to a higher target capacity.

The transmission adequacy prospect along the corridor is depicted in the Figure 3.1, showing that for most of the boundaries in the region, the TYNDP project portfolio provides already the appropriate solutions to meet the target capacity. On the boundary GB-Continent and Nordics, there may be still room for potential grid development, deserving further investigations in the framework of common planning activities. Despite the four projects included in the Plan, the boundary of the Iberian Peninsula is still red, due to Spain still not reaching the 10% interconnection ratio objective (falling short in visions 1 and 2).

Figure 3-1 Transmission Adequacy in Western Europe

For more details read Insight report “North Seas regional planning” ↩

MIBEL – the Iberian Energy market ↩

Projects promoted by non-ENTSOE members that did not fulfil the draft EC Guidelines at the time the list of TYNDP projects was closed are assessed in the TYNDP, but not included here. ↩

Interconnections between Italy and Austria and between Italy and Slovenia are described in the Insight Report: North-South Interconnections in Central-East and South-East Europe. ↩